Our Value-added Tax Refund Solutions

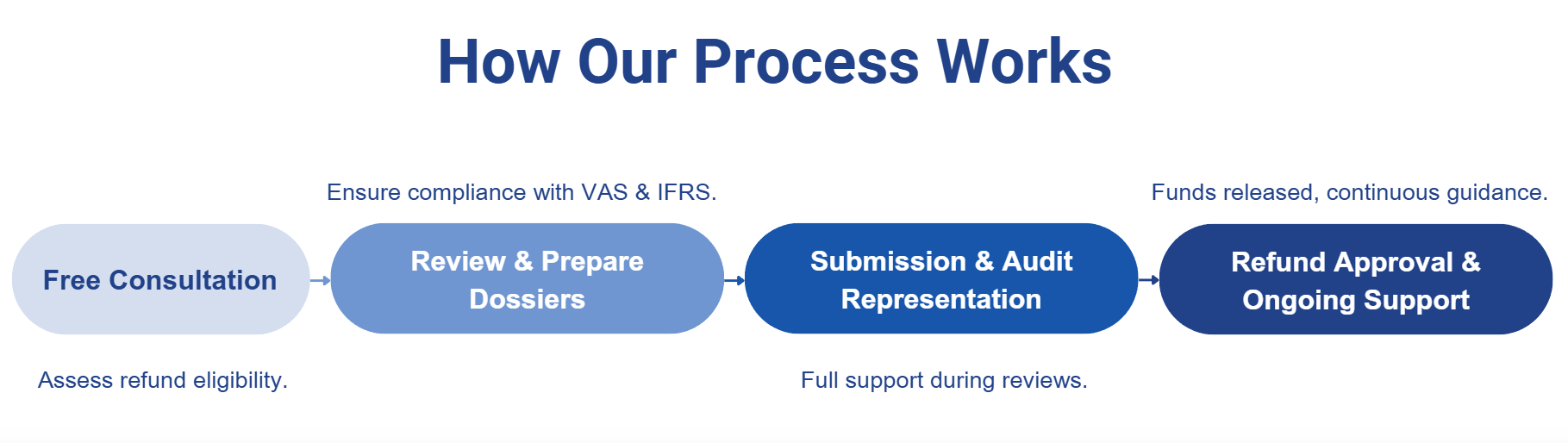

VAT refund services streamline recovery with clear, benefit-driven steps tailored to each business.

🟠 VAT Refund Processing

VAT refund services streamline recovery with clear, benefit-driven steps, from preparing and submitting bilingual dossiers to adjusting returns and responding to tax authorities. Recover up to 100% of eligible VAT while boosting liquidity and cash flow.

🟠Audit Representation

Full support during tax authority audits, including explaining accounting books and invoices, and monitoring to expedite refund approvals. Minimize stress while ensuring penalty-free compliance.

🟠 Tax Incentive Optimization

Leverage FDI-specific VAT incentives by identifying and applying eligible exemptions or reductions, saving up to 15–20% on tax liabilities.

🟠Broader Tax Support

Handle corporate and personal income tax refunds when applicable, integrating VAT refunds with other tax recovery strategies for a holistic approach that maximizes overall savings.

Key Deliverables for FDI & SME Clients

Quarterly & Annual Tax Return Reports

Ensure timely and accurate reporting to maximize eligible refunds.

Bilingual Dossiers for All Tax Types

Facilitate smooth communication with authorities and prevent errors.

Tax Incentive Applications for FDI Businesses

Identify and apply exemptions to reduce overall tax liabilities.

Full Audit Support & Representation

Minimize stress and secure compliance during tax authority audits.

Guidance on International Tax Treaties

Leverage global agreements to optimize cross-border tax positions.

Proven Experts You Can Trust

🟠 10+ years of expertise in VAT, CIT, and personal income tax

🟠 Certified in VAS, IFRS, and international tax law

🟠 Strong partnerships with the General Department of Taxation for efficient processing

Schedule a 30-minutes call

with our consultant and get solutions for your

business in Vietnam.

CONTACT US

VINA TPT COMPANY LIMITED

Tax Identification Number: 0315968958

THE CLASSLIB COMPANY LIMITED

Tax Identification Number: 0313916707

Tel: +8428 730 40 790 | Email: infor@vinatpt.com

Office: 5th Floor, More Building, 83B Hoang Sa Street, Tan Dinh Ward, Ho Chi Minh City, Vietnam