1. Vietnam – The Next Hub for Korean Electronics Manufacturers

As Korean companies continue to look for new growth opportunities across Asia, Vietnam has become one of the most attractive destinations for manufacturing expansion. With a favorable investment climate and a streamlined business license in Vietnam process for foreign enterprises, Vietnam offers Korean electronics manufacturers an ideal entry point to establish long-term operations. Supported by government incentives and a robust supply chain ecosystem, the country is quickly evolving into a major production hub in the region.

Major corporations such as Samsung, LG, and Hanwha have established large-scale production complexes in Bac Ninh, Thai Nguyen, and Hai Phong, regions that are rapidly becoming Vietnam’s key electronics hubs, supported by modern logistics networks, seaports, and government investment incentives.

Moreover, Vietnam’s active participation in free trade agreements such as CPTPP and EVFTA has unlocked significant tariff advantages, enhancing its competitiveness in the global supply chain. A young, skilled workforce combined with the nation’s push for digital transformation positions Vietnam as the “new manufacturing base” for the global electronics industry, much like South Korea’s industrial rise in the 1990s.

For Korean investors, establishing a business in Vietnam not only optimizes production costs but also opens access to ASEAN, China, and India markets. By obtaining the appropriate business license in Vietnam and leveraging professional strategic consulting, Korean electronics enterprises can streamline the enterprise registration process and transform Vietnam into a sustainable hub for manufacturing and innovation in the region.

2. Strategic Considerations Before Enterprise Registration in Vietnam

Before starting the registration process, investors need to carefully consider strategic factors.

Location is key: Northern regions such as Bac Ninh, Hai Phong, Thai Nguyen currently have many Korean electronics factories, convenient for connecting and sharing the supply chain.

Legal form also directly affects the right to operate and tax obligations. Enterprises can choose to establish a 100% foreign-owned company, joint venture with a Vietnamese partner or open a representative office.

In addition, the domestic supply chain in Vietnam is expanding rapidly, providing components and logistics services suitable for electronics production. Understanding these factors helps Korean enterprises optimize costs and limit risks when entering new markets.

Book a Free Consultation on Your Business License

3. Understanding Business License in Vietnam and Compliance for Electronics Companies

After being granted the Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC), the electronics enterprise needs to apply for a business license appropriate to the field of operation.

The electronics manufacturing industry has its own requirements on environmental safety, technology standards and fire prevention.

The estimated time for completion is:

Document preparation: 1-2 weeks, depending on the volume of documents and the level of complexity.

- IRC appraisal: 20-45 working days.

- ERC issuance: 10-20 working days after IRC (or similar if the enterprise is a domestic enterprise).

In fact, if the enterprise cooperates with a reputable company registration service, it will help the enterprise quickly handle the consular legalization, translation and submission of documents, shortening the time and increasing the possibility of being licensed the first time.

4. How to Establish Business in Vietnam and Maintain Legal Compliance

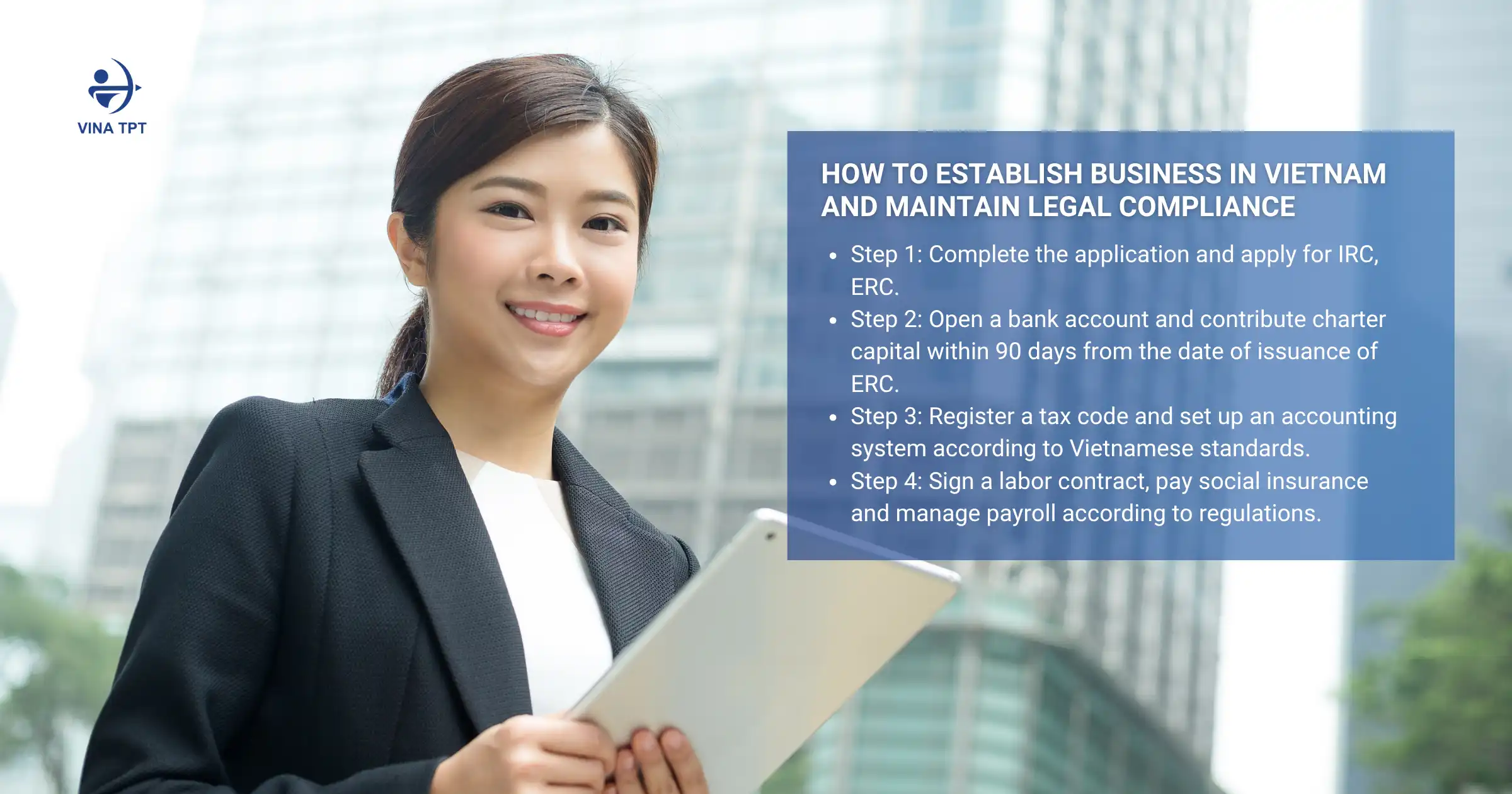

To successfully establish a business in Vietnam, investors need to take the following important steps:

Step 1: Complete the application and apply for Business License in Vietnam IRC, ERC.

If the project has FDI capital, IRC is the first license allowing the investor to implement the project in Vietnam.

The required documents usually include:

- Application for investment project implementation and Project proposal: stating the objectives, scale, location, investment capital, progress.

- Proof of the investor’s financial capacity: bank statement, credit contract or collateral.

- Legal documents of the investor:

- Individual: Notarized passport, consular legalization.

- Organization: Business registration certificate or equivalent document, consular legalization.

- Project location: lease contract or land/office use rights certificate.

After the IRC is granted (or for 100% domestic-owned enterprises), the investor applies for an ERC – an official license for the enterprise to operate, and also the tax code of the company.

The ERC dossier usually includes:

- Application for enterprise registration.

- Company Charter: stipulates the organizational structure, powers of members/shareholders, capital ratio and management method.

- List of members/shareholders and legal representatives: clearly state information, ownership ratio, voting rights.

- Appointment decision and authorization letter (if any).

- Capital contribution plan & financial evidence: bank statement or credit contract (especially important for large capital projects).

Step 2: Open a bank account and contribute charter capital within 90 days from the date of issuance of ERC.

Step 3: Register a tax code and set up an accounting system according to Vietnamese standards.

Step 4: Sign a labor contract, pay social insurance and manage payroll according to regulations.

5. Vina TPT Company Registration – Partnering with Korean Electronics Manufacturers for a Sustainable Setup

With more than a decade of experience in investment consulting and business registration services, Vina TPT has successfully assisted hundreds of FDI enterprises, including a large number of Korean electronics manufacturers in establishing and expanding their operations in Vietnam.

Our comprehensive service scope covers every stage of the process — from investment model consulting and legal documentation, to business license application in Vietnam, business license renewal, and regulatory compliance. This integrated approach ensures a smooth and compliant market entry for Korean investors.

Backed by a team of seasoned professionals with in-depth knowledge of Vietnam’s business, tax, and labor laws, Vina TPT provides end-to-end business license advisory and compliance support, helping investors confidently execute their projects while focusing on production growth and long-term success.

Partnering with Vina TPT Business Advisory and Company Registration means more than saving time and costs. It’s about having a trusted local partner who truly understands how to help Korean investors establish, operate, and sustain successful ventures in Vietnam.