1. Overview of Financial Reporting & Tax Finalization in Vietnam 2025

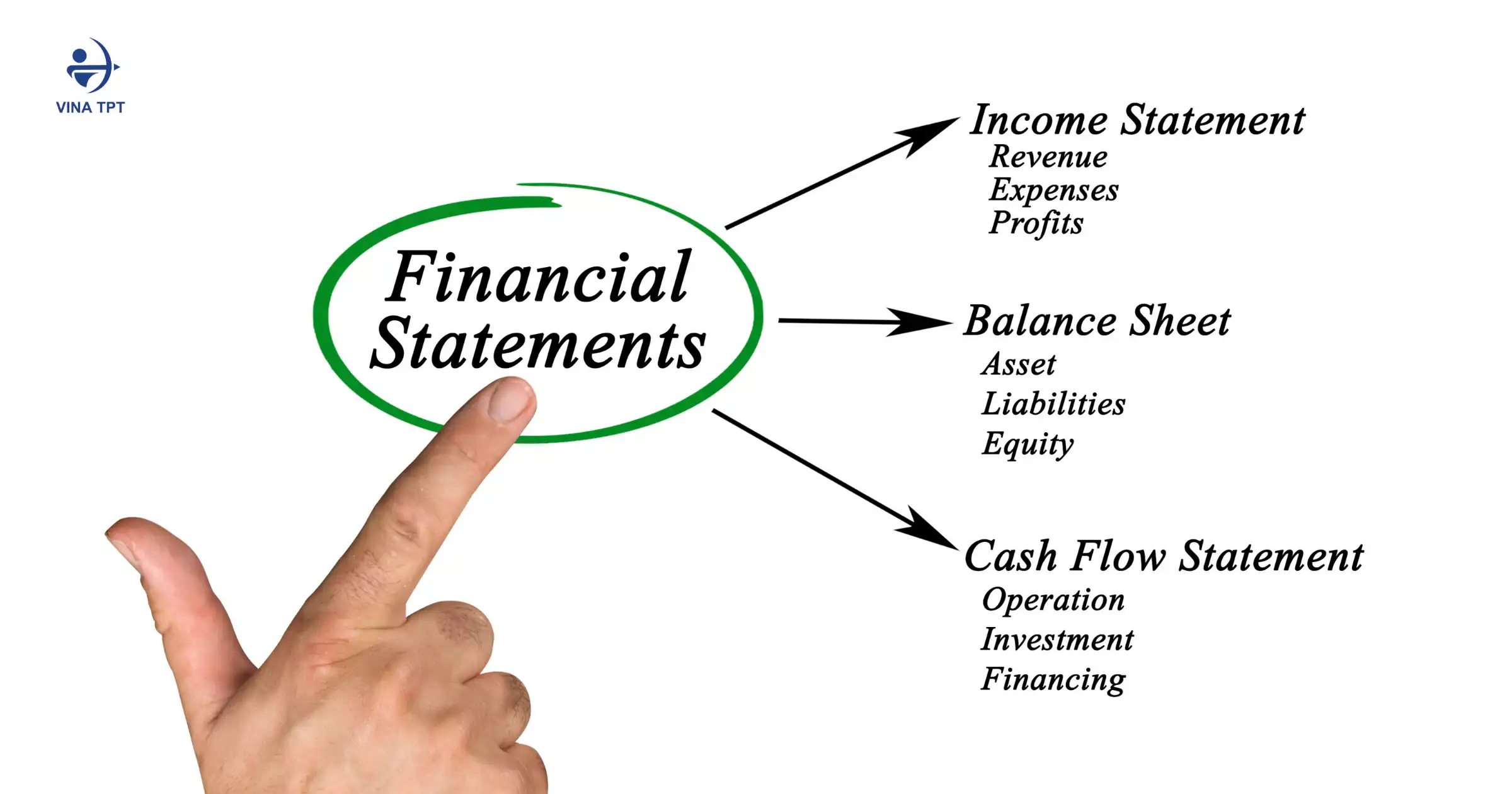

In 2025, FDI enterprises and domestic enterprises in Vietnam must fully comply with financial reporting and tax settlement obligations as prescribed. The annual financial statements include the Balance Sheet, Income Statement, Cash Flow Statement and Notes to the Financial Statements, all of which must be prepared in accordance with Vietnamese Accounting Standards (VAS).

In parallel with preparing the Financial Statements, enterprises must make corporate income tax and personal income tax settlements within 90 days from the end of the fiscal year. The increase in the frequency of reviews and inspections by tax authorities requires enterprises to have accurate data, a synchronous accounting system and complete records to avoid the risk of being penalized.

2. Vina TPT’s Financial Statement Services

Vina TPT provides in-depth financial reporting services, helping businesses prepare accurate, transparent and fully VAS-compliant reports. Not only synthesizing data, we also provide a clear view of the financial situation and ensure readiness for audits or tax inspections.

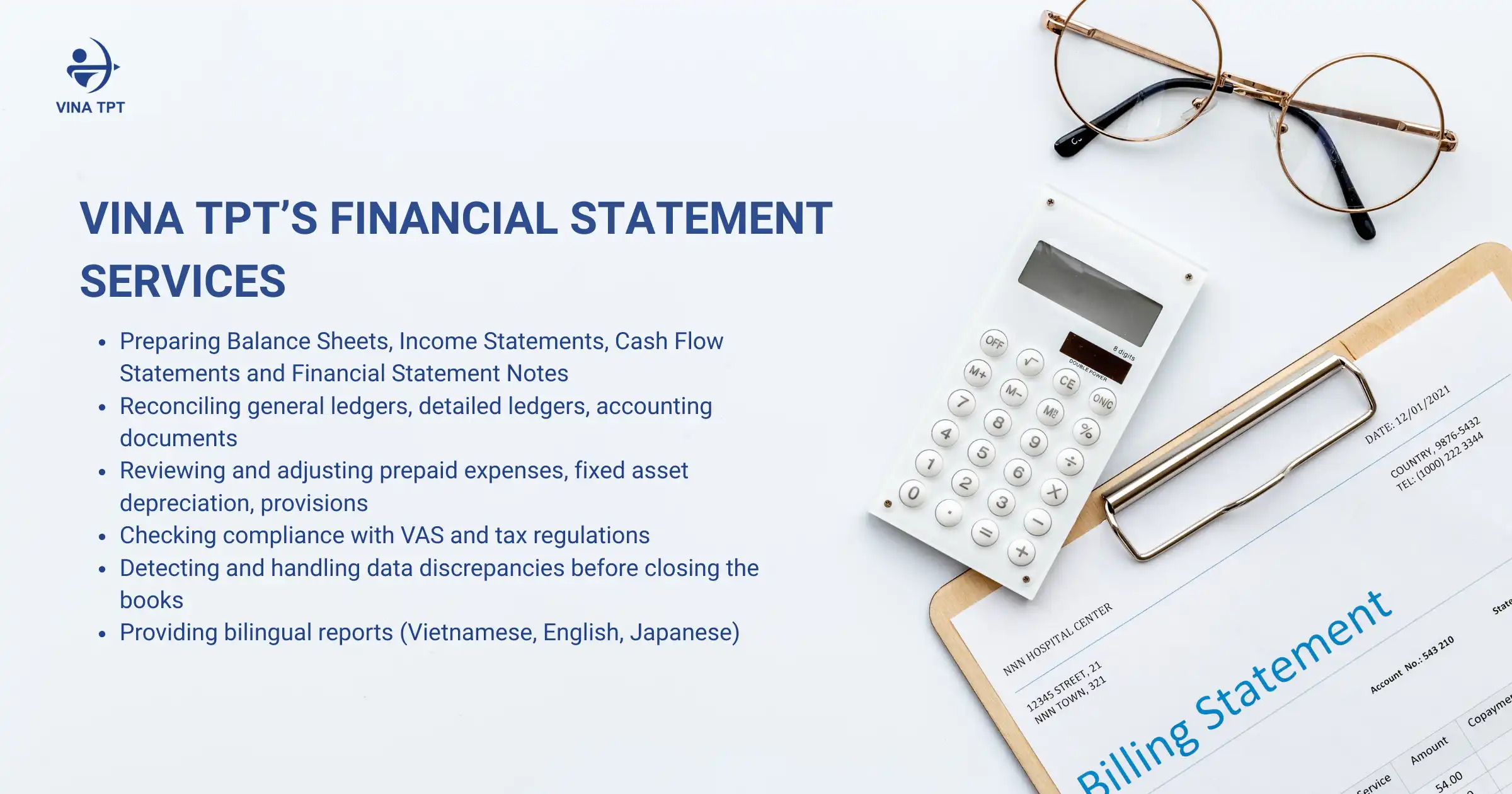

Vina TPT’s financial reporting services include:

- Preparing Balance Sheets, Income Statements, Cash Flow Statements and Financial Statement Notes

- Reconciling general ledgers, detailed ledgers, accounting documents

- Reviewing and adjusting prepaid expenses, fixed asset depreciation, provisions

- Checking compliance with VAS and tax regulations

- Detecting and handling data discrepancies before closing the books

- Providing bilingual reports (Vietnamese, English, Japanese)

3. Corporate Income Tax (CIT) Finalization Services

Vina TPT provides in-depth corporate income tax settlement services, helping businesses control data, comply with regulations and limit errors in the context of many important adjustments to tax policies and the Enterprise Law from October 1, 2025.

3.1 Review expenses and determine taxable profits

Vina TPT checks all expenses to determine which are deductible and which are not deductible in accordance with the Corporate Income Tax Law; reviews depreciation of fixed assets, interest expenses, provisions and expenses that are easily excluded during tax inspections. At the same time, the team compares data between financial statements and tax declarations to accurately calculate taxable profits, ensuring that there are no difficult-to-explain differences.

3.2 Prepare corporate income tax settlement declarations and in-depth risk assessment

The service includes full preparation of declarations, loss transfer appendices, tax incentives, cost analysis tables and explanation documents according to tax inspection standards. Vina TPT also analyzes risks by group such as costs without sufficient documents, incorrect revenue-expense periods, discrepancies in electronic invoice data, or lack of linked transaction records. From there, it proposes solutions to reduce the risk of collection and fines.

3.3 Tax optimization consulting and notes on new regulations from October 1, 2025

Vina TPT supports businesses in applying tax incentives to the right subjects, implementing valid loss transfers, and optimizing tax obligations based on legal mechanisms. In particular, changes effective from October 1, 2025 related to electronic records management, tightening cost control, and expanding explanation requirements make the settlement process more stringent; businesses need to carefully compare data, contracts, and documents to avoid risks when tax authorities inspect.

4. Personal Income Tax (PIT) Finalization for Employees & Foreigners

Personal income tax settlement is a major challenge for businesses with large staff numbers, diverse income structures or foreign employees. Vina TPT provides a complete PIT solution, helping businesses process quickly, correctly and fully comply with new regulations.

4.1 Review PIT data and prepare settlement documents

Vina TPT checks tax data of each employee monthly (income, exemptions, deductions, working days, taxes paid) to ensure consistent data before making settlement. At the same time, collect and check all documents: labor contracts, payroll, residence papers, entry/exit history of foreign experts… to help businesses have accurate data from the beginning of the year.

4.2 Preparation and submission of PIT settlement dossiers and tax refund support

Services include preparing PIT settlement declarations for businesses and individuals, correctly classifying residents and non-residents, applying double taxation agreements (DTA) if any, and submitting dossiers on time. Vina TPT also carries out tax refund procedures for employees and foreign experts, monitors the processing process and works with tax authorities to ensure that dossiers are processed quickly.

4.3 Representing and working with tax authorities and providing in-depth advice for foreign workers

Vina TPT represents businesses when requested by tax authorities, helping to reduce the workload for HR and accounting departments. At the same time, it provides in-depth advice on tax residency, applying DTA, handling business trips to multiple countries, income arising outside of Vietnam, or common international risks. This is especially important for businesses that employ many foreign experts and need to comply with cross-border tax standards.

5. Common Pain Points & Why Businesses Need Professional Support

At the end of each year, many businesses face difficulties due to:

- Incorrect data or inconsistent recording

- Lack of documents or incomplete records

- Internal accounting systems and reporting to parent companies are not synchronized

- Late submission deadlines due to limited staff

- Risks of fines and additional collection when tax authorities inspect

- Lack of expertise in VAS and complex tax regulations

Professional services from Vina TPT help businesses avoid these risks and ensure the tax filing process runs smoothly.

6. Why Choose Vina TPT for Reporting & Tax Services

Values:

- Vina TPT helps businesses maintain a transparent accounting system, accurate reporting and minimize tax risks in the context of increasingly strict inspections.

Professional capacity:

- A team of accountants & tax experts with many years of experience in FDI enterprises

- Deep understanding of VAS and financial reporting according to international standards

- Bilingual support in Vietnamese – English – Japanese

Service commitment:

- Clear process, fast processing time

- Data security and absolute compliance with legal regulations

- Optimal cost according to scale and workload

7. Comprehensive Service Package for FDI Enterprises

Vina TPT provides One-Stop Tax & Accounting Solution, including:

- Annual Financial Report

- Corporate Income Tax Finalization

- Personal Income Tax Finalization

- Accounting & Bookkeeping Services

- Payroll, Labor Report

- Support for Foreign Labor Compliance

- Support for Working with Tax Authorities, Inspections & Audits

Consistency

- All services are deployed synchronously according to one system, avoiding data discrepancies between departments and reducing risks during audits.

Long-term Benefits

- A suitable solution for FDI enterprises that need stability, transparency and long-term support in a volatile legal environment.

Start with Vina TPT to complete financial reports and tax settlement 2025 quickly!